Quick answer

Want to outmaneuver the competition? Start by understanding exactly where they are, who they’re targeting, and how your sales team can win in the gaps they leave behind.

Key takeaways

- Map competitor location to find whitespaces and high-risk zones

- Layer customer, competitor, and market data to turn your gut instinct into strategic action

- Companies that use visual insights see faster ramp-up, stronger targeting, and more confident sales plays

What Competitive Insights Matter in Dales?

In sales, the most valuable competitor insights are those that help your team position more effectively, win more deals, and avoid wasted effort.

Here are the key competitive insights that matter in sales:

- Competitor presence by territory

- Product or service differentiators

- Buyer feedback and objections

- Market share and customer wins

- Sales strategy and tactics

- Digital and content footprint

Why do they matter? When your sales team can access real-time, location-specific, and strategic competitor insights, they can tailor pitches, avoid saturated markets, outmaneuver rivals, and close more deals.

How to Gather Competitive

Insights in 4 Steps

- Assess your current market

- Gather competitor landscape information

- Layer additional sales data

- Establish your strategic plan

All businesses differ, so we focus on high-level use cases that resonate with you.

Step 1

Assess Your Current Market

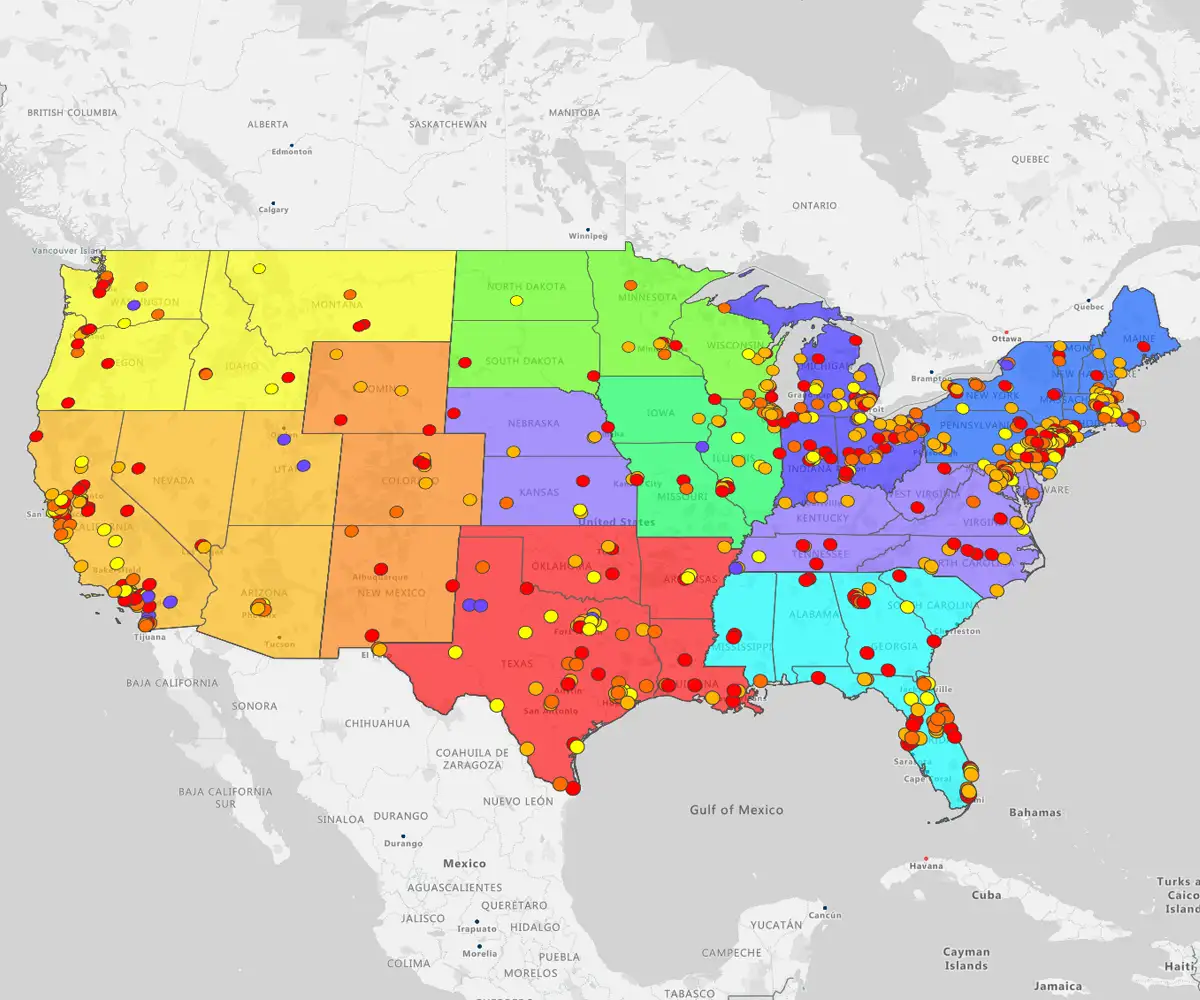

To build a competitive sales strategy, start by evaluating where your team currently stands. A great question to ask yourself is, "Where are your sales resources?". You know who your sales reps are and where they are located. But do you have clarity on your customer or prospect locations?

Seeing customer locations on maps is transformational. It provides critical context for resource planning, territory coverage, and future growth.

Identify Sweet Spot Clients

Your Sweet Spot Client are the top 20% of customers who deliver 80% of your sales potential in each sales territory. Filtering your CRM or lead database to isolate these high-value accounts helps sharpen your focus.

When you plot them on maps, you can ask two critical questions.

- What does it tell you about your serviceability?

- Are you able to service customers effectively?

Visualize Sales Coverage

Next, map your broader sales footprint, start by asking:

- Which geographic regions, industries, or segments have the highest sales potential?

- Where do we have the strongest product-market fit?

- Where is the competition weakest?

- Which markets are easiest to penetrate or quickest to close?

The goal is to build a clear, data-driven hierarchy of target markets so you can allocate sales reps, campaigns, and resources efficiently, focusing first on the best opportunities.

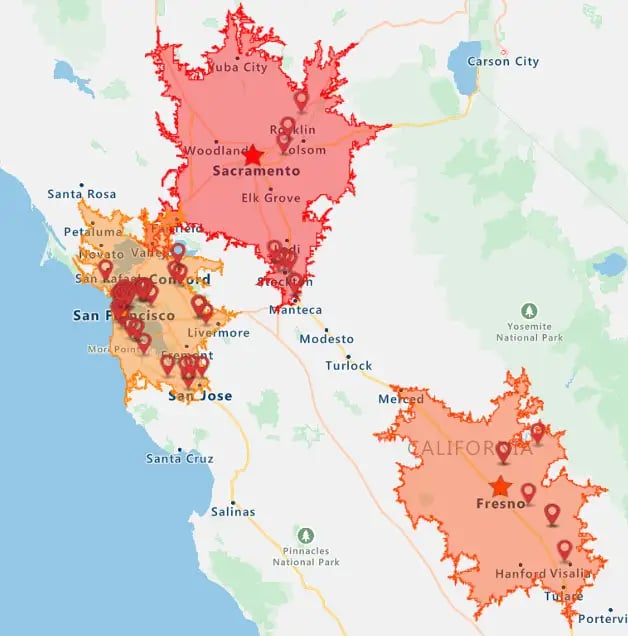

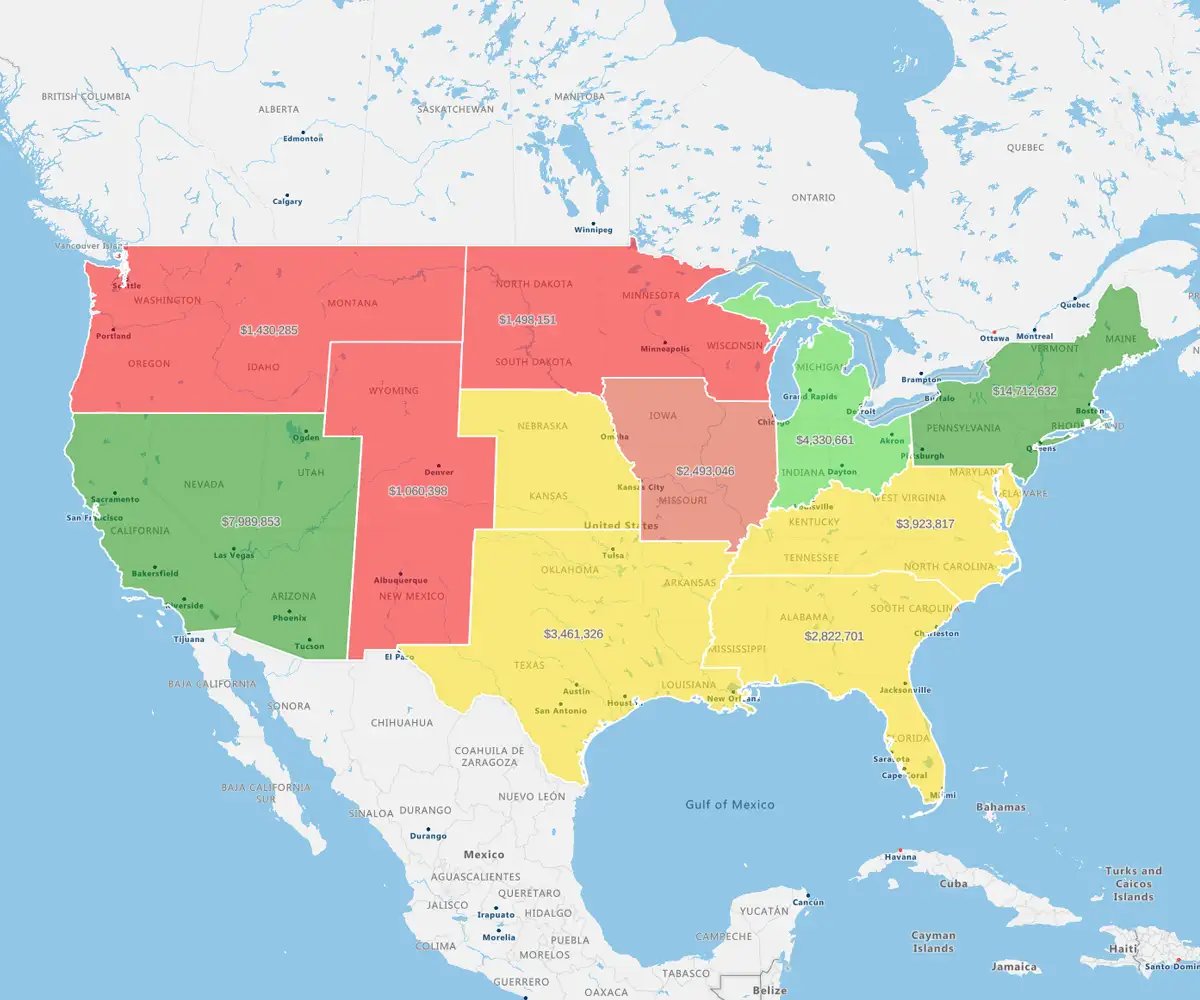

Compare Market Performance & Serviceability

You'll want a clear market landscape analysis. To assess your current markets, start by aggregating historical sales and sales potential (future sales potential).

What is sales potential? It is the sum of customer spending with all suppliers in your competitive space. So, for example, your top customer spends $200,000 per year on your products or services. But it only represents 10% of their total spending. The sales potential is $2,000,000. You may adjust this based on a realistic share of your wallet; let's agree your maximum share would be 50%, so your real sales potential is $1,000,000.

Now you have a clear picture of sales potential and have done your sales market analysis, start creating serviceability zones based on your current resources. Can you adequately service customers and prospects and increase your sales potential?

Using a tool like eSpatial, you can assess average distance or perform a drive time analysis. It unlocks a better understanding of "time to service" customers. And you can reset your priorities based on customer priority. You can then redesign or re-optimize sales territories to focus on the customers with the highest sales potential.

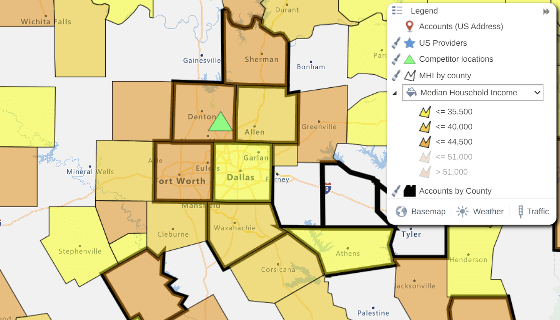

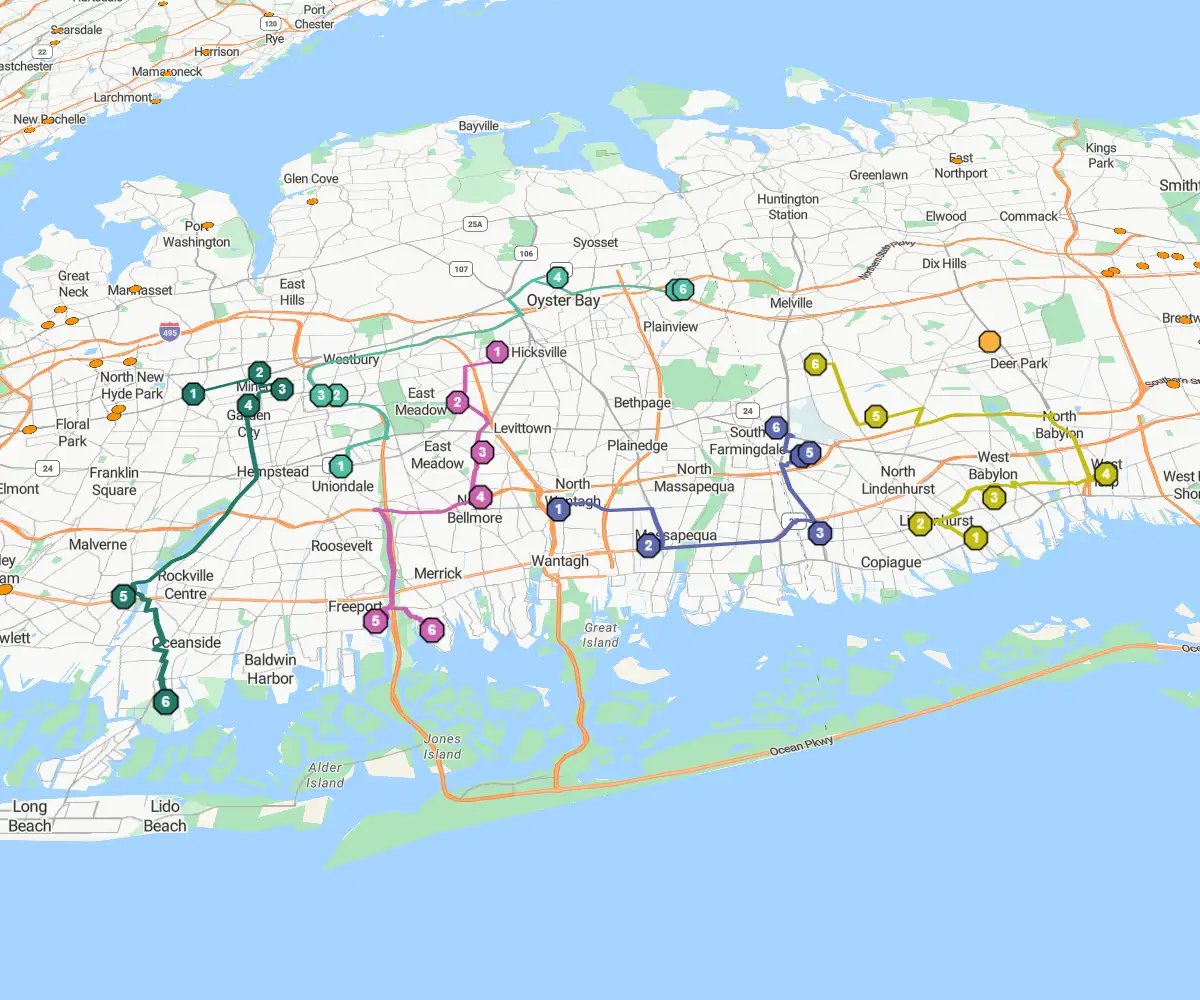

See below for an example:

You can analyze average drive time and sales potential and identify trends in the data that enable you to plan resources better.

You can identify whitespaces, or gaps in your sales coverage that could yield new sales opportunities.

Step 2

Gather Competitor Landscape Information

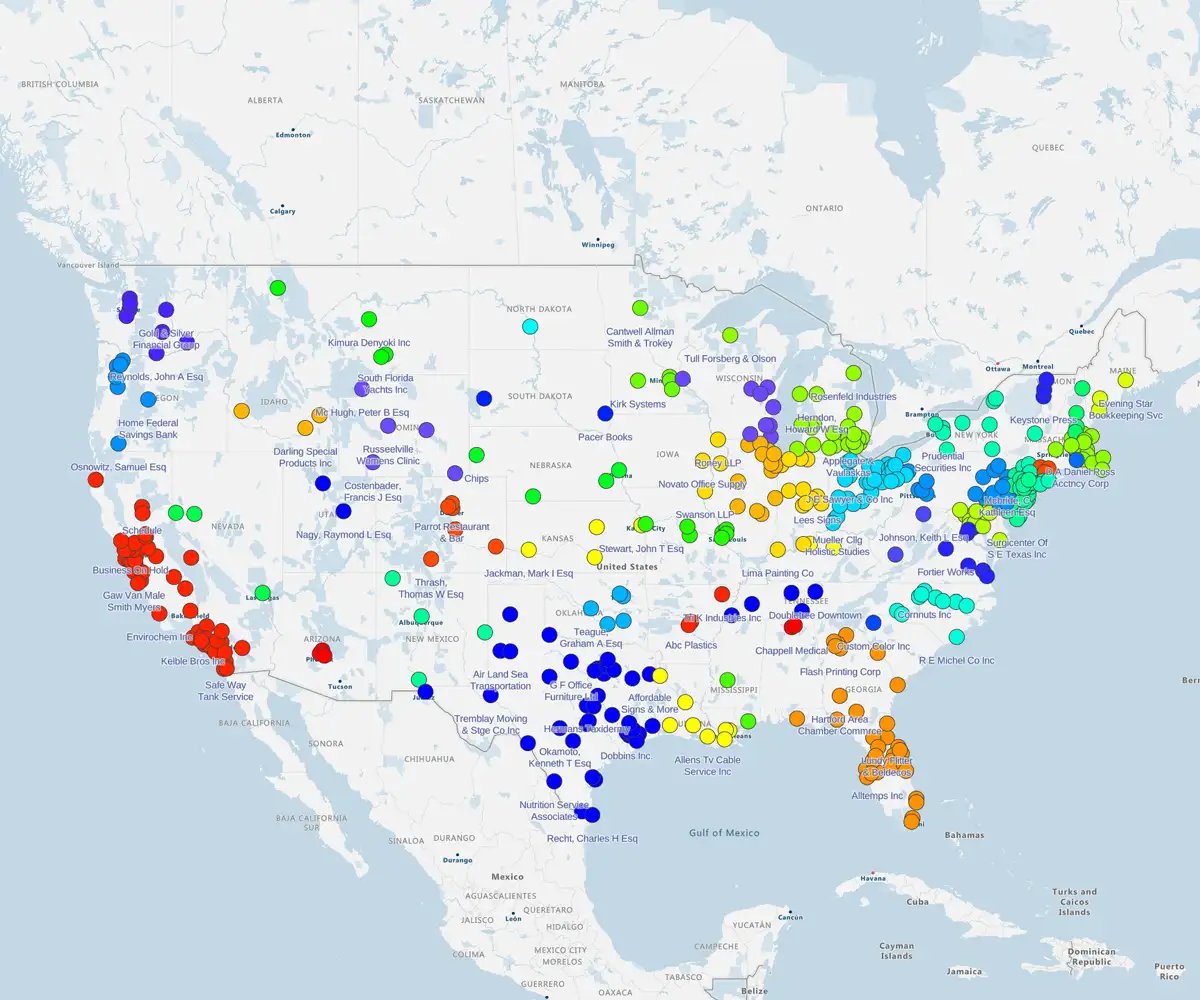

Using sales territory mapping software, ask these questions to learn how to analyze the competition:

- Where are your competitors located?

- How do their locations compare to yours?

- How do their locations impact your highest value customers?

- How do their locations compare to your prospect sites?

- Where can you capitalize on their locations to gain a competitive advantage?

Collect location data in a spreadsheet with columns such as name, address, city, ZIP/postcode, and category (if needed). This data can come from public directories, sales intel tools, the eSpatial library, or your CRM.

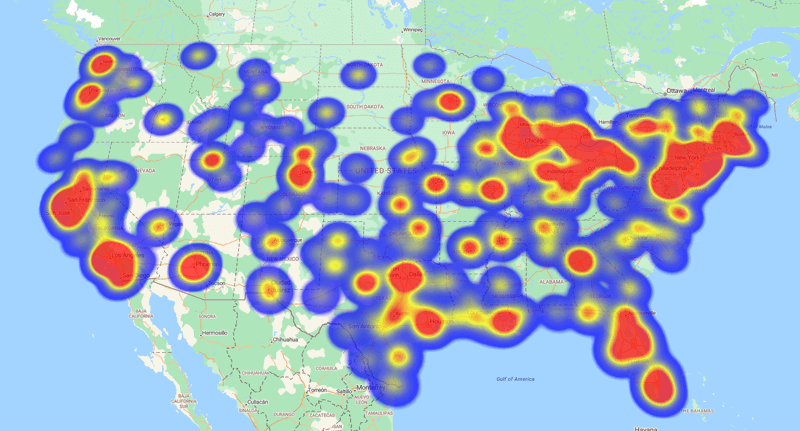

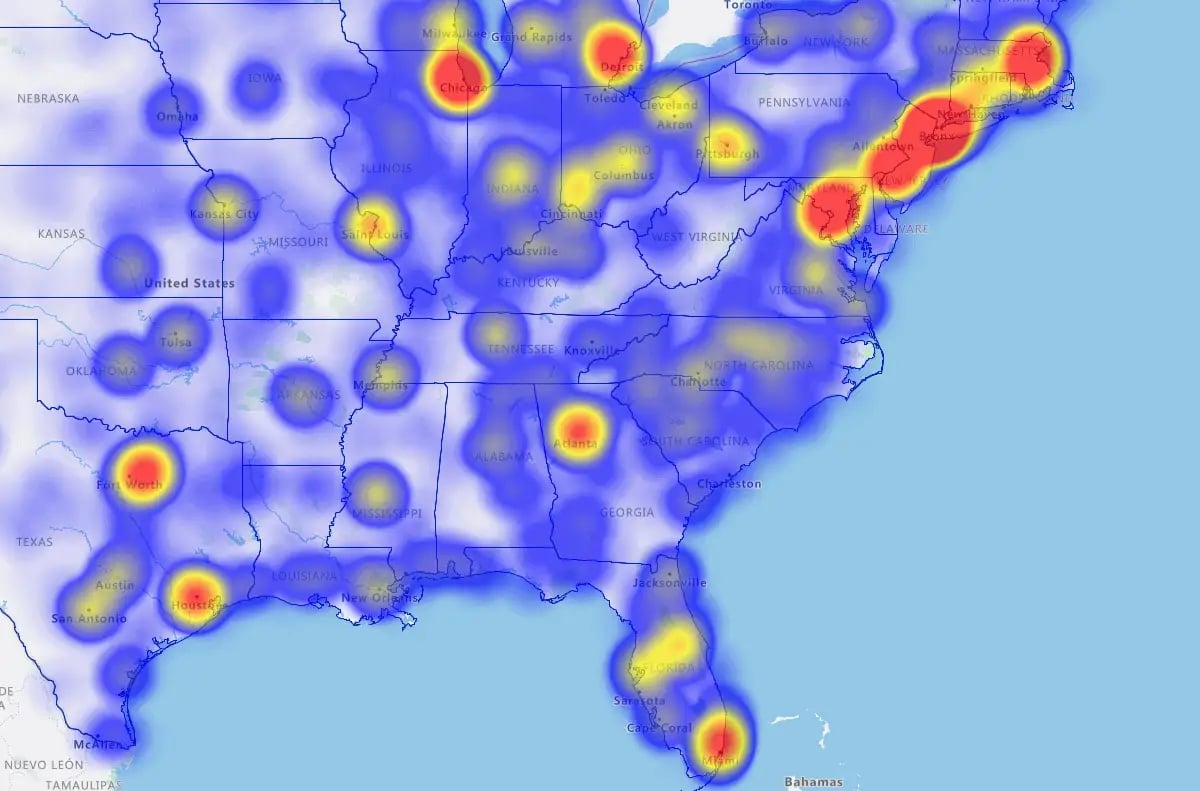

Spot Threats and Opportunities

Start with a macro-level evaluation.

- Where is your business?

- Where do you need to protect?

- Where can you grow?

See the example; you can make some high-level evaluations. You can see areas where there is a threat to your business. And where you have the opportunity to grow. For example, in Denver, Dallas, and Houston, you have high sales but no market coverage. Examine individual markets at a micro-level. Assess the market threat, prioritize resources where needed, and consider adjustments.

Step 3

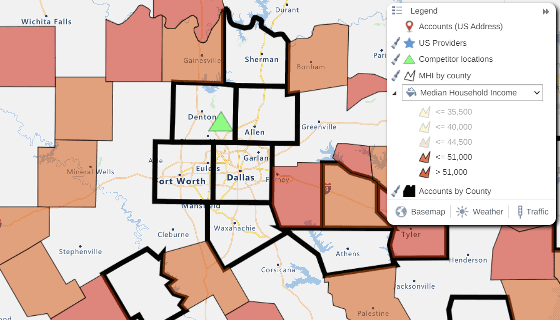

Layer Additional Sales Data

Once you've mapped your market and competitors, it's time to dig deeper. Layer more sales data to profile your best and worst areas. Ask:

- What is the data showing?

- Where are your high-value areas?

- What are customers buying?

- What is the customer profile most likely to buy from you?

- How many fit your Sweet Spot Client profile?

- Where are there more customers like this?

Add Key Metrics

Whether in B2C or B2B, you should consider the critical result metrics to analyze. We recommend including a sales potential metric or workload index when creating sales territories.

Think about industry data too:

- Healthcare demographics

- Insurance risk scores/rates by location

- Construction - Dodge data (which shows where permits are registered)

- Finance - CMA compliance data

- Housing - HUD data

Challenge Your Assumptions

Market data doesn't always tell the story you expect. In this example, the sales team assumed their Sweet Spot Client were high-income households. But the heatmap layered with customer data proves the opposite: they were selling to mostly lower-income families.

By zooming into Dallas/Fort Worth and adding a 60-minute buffer, the team uncovered untapped potential worth $200,000 in revenue. With an average customer value of $6,000, that translates to over 30 potential new accounts — enough to justify expanding sales coverage in that region.

Assumption

We sell to high income households

Reality

In Dallas/Ft. Worth, customer demographics show lower income

Step 4

Establish Your Strategic Plan

Now you have some new approaches that help you uncover some sales potential or new areas to develop. You are in a position to develop a plan to implement the insights gained from your analysis. Each plan will be unique to your organization, but the approach to unlocking the insights is consistent. Ensure that you schedule regular reviews using the 4-step process, and the impact will be tangible.

How to Apply Competitive

Insights in Your Strategy

To turn your competitor insights into a real sales advantage, you need to put them into action. From refining outreach to reallocating resources and planning for better route optimization for field sales teams, here's how to use your market intelligence gathering to sell smarter, move faster, and win more deals.

Reallocate Sales Resources

Identify underserved areas, high‑potential markets, or regions with heavy competitor presence. With this clarity, you can shift reps or resources to places with the best opportunity for growth or defense.

Refine Targeting and Outreach

Pinpoint customer clusters, competitor locations, and local market trends to tailor your messaging and campaigns. Focus your outreach on areas where your solution fills gaps or stands out from competitors.

Build Stronger Business Cases

Use visual data to back up proposals for new territories, product launches, or sales team expansion. Clear maps and market analysis help stakeholders quickly see the opportunity and potential ROI.

Improve Sales Coaching

Spot patterns in win/loss data, territory performance, and competitor pressure. This gives sales managers evidence‑based insights to coach reps, address challenges, and replicate what works in top‑performing areas.

Optimize Route Planning

Combine competitor insights and market data with route optimization tools, such as a multi-stop route planner and route sales software for reps, to prioritize high‑value visits and avoid low‑return areas. Smarter routing saves time, reduces costs, and keeps your team focused on the biggest opportunities.