Quick answer

Markets shift, products evolve, and teams grow. If your territory map doesn't adapt to these realities, you effectively cap your own growth.

The Signal: Here are the clear signs your sales territory map is broken.

1. The Revenue Rollercoaster

- The symptom: Huge disparity in performance. One rep is hitting 200% of quota with ease, while a talented peer struggles to hit 60%.

- The diagnosis: Your territories are inequitable. You are leaving money on the table in the "starving" regions and likely under-servicing the "feasting" ones.

2. Strategic Drift

- The symptom: You've launched new products, merged with a company, or pivoted strategy, but your map looks the same as it did two years ago.

- The diagnosis: Your territories are fighting your strategy. You need to realign coverage to support the new mission, not the old one.

3. Disruption (Cannibalization)

- The symptom: Reps are tripping over each other, fighting for credit on the same accounts, or calling the same prospects.

- The diagnosis: Unclear boundaries are causing internal competition. This wastes time and creates a terrible customer experience.

4. Burnout & Churn

- The symptom: Performance metrics are sliding, and morale is tanking. Good reps are quitting because their patch feels "tapped out."

- The diagnosis: The workload doesn't match the opportunity. You are burning out talent by asking for blood from a stone.

5. The Service Gap (Coverage Gaps)

- The symptom: Leads are going cold, or customers complain they haven't seen a rep in months.

- The diagnosis: You have "ghost zones"—areas with potential that no one owns. This is pure waste.

10 Signs It's Time for Territory Optimization

Territory optimization isn't a "nice to have"—it's how you align sales efforts with market reality. Watch for these 10 red flags.

1. The Revenue Rollercoaster

- The Symptom: Massive disparity. One rep crushes quota while another starves, despite equal effort.

- The Diagnosis: Inequity. Your market potential is unbalanced, setting some up to fail and others to coast.

2. Market Drift

- The Symptom: Demographics shifted, competitors moved in, or regulations changed—but your map looks like it did in 2019.

- The Diagnosis: Obsolescence. You are ignoring high-growth regions to serve a market that no longer exists.

3. Cannibalization

- The Symptom: Reps are crossing paths, calling the same prospects, or fighting over commission credit.

- The Diagnosis: Internal Friction. Unclear boundaries waste resources and confuse the customer.

4. Growing Pains

- The Symptom: You’ve expanded into new markets or added headcount, but haven't redrawn the lines.

- The Diagnosis: Scale Failure. Your old map can't support your new size, leaving opportunities untapped.

5. Product Mismatch

- The Symptom: You shifted focus (e.g., hardware to software), but your territories prioritize the old buyer profile.

- The Diagnosis: Strategic Misalignment. You are wasting resources on irrelevant markets instead of targeting early adopters.

6. Metric Meltdown

- The Symptom: Conversion rates are dipping and sales cycles are dragging, even with a solid team.

- The Diagnosis: Structural Blockage. The territory design itself is hindering the deal flow.

7. The Burnout Trap

- The Symptom: High turnover and exhausted reps. Some are drowning in work; others are bored.

- The Diagnosis: Imbalance. You are burning out talent by failing to distribute the load fairly.

8. Frontline Friction

- The Symptom: Your reps—the people closest to the ground—are complaining about inefficient routes or impossible travel.

- The Diagnosis: Operational Blindness. You are ignoring the "ground truth." If they say it's broken, it usually is.

9. Ghost Zones (Coverage Gaps)

- The Symptom: Rural areas are ignored, or smaller clients haven't heard from you in months.

- The Diagnosis: Leaky Bucket. You are ceding territory to competitors simply because no one "owns" those accounts.

10. Post-Merger Disruption

- The Symptom: After an acquisition or restructure, you still have legacy territories that don't match the new org chart.

- The Diagnosis: Organizational Drag. Old maps prevent you from realizing the efficiencies of the restructure.

5 Steps to a Data-driven Territory Refresh

If you spot the red flags, you need a realignment based on facts, not feelings.A data-driven refresh ensures your changes lead to measurable performance improvements, rather than just shuffling the deck chairs.

1. Start with Hard Data

The foundation is metrics. Gut feel creates imbalance. Evaluate your current map by analyzing:

- Sales Performance: Revenue, win rates, conversion rates

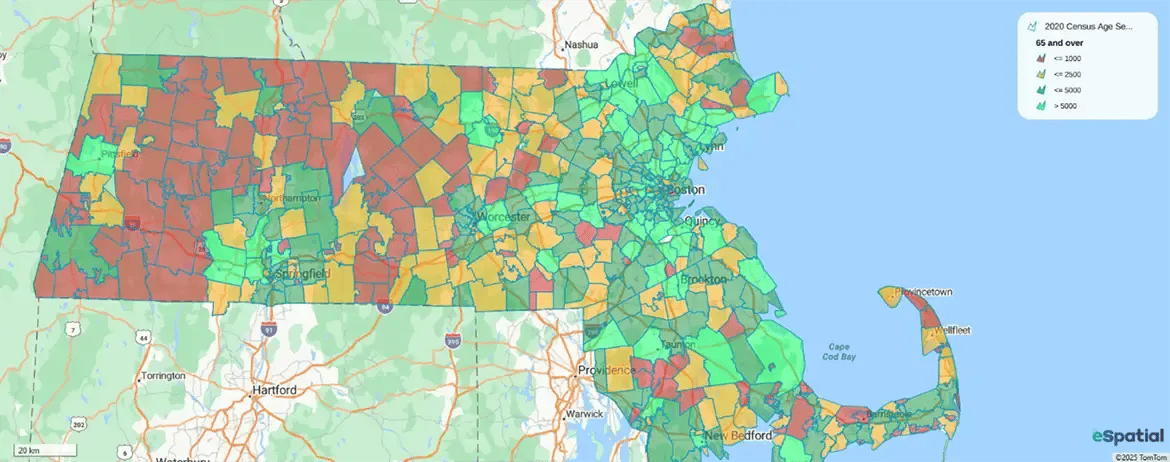

- Demographics: Where your ideal customers actually live

- Travel: Real-world drive times and patterns

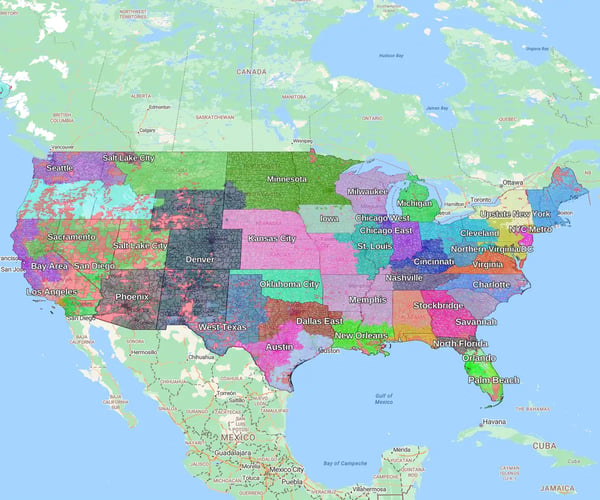

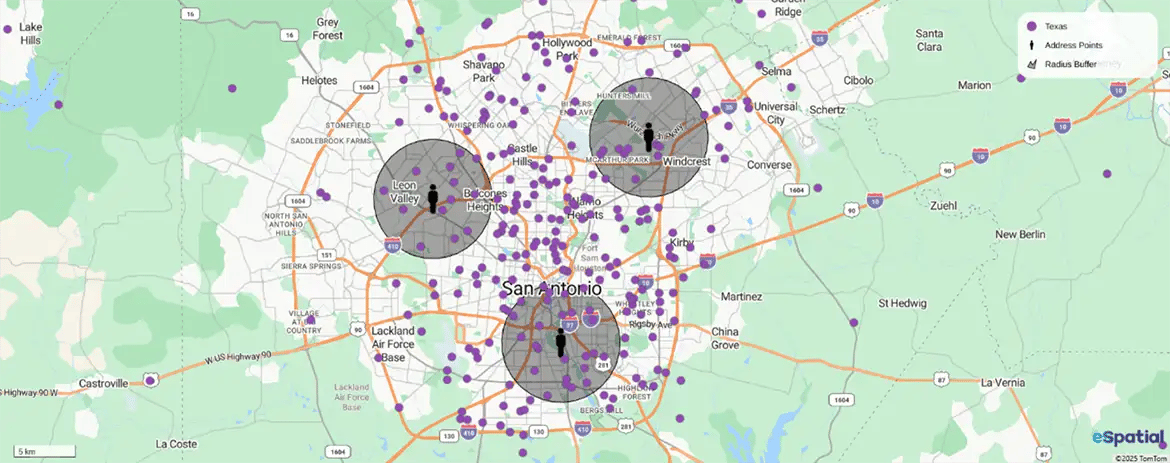

The fix: Use mapping software to visualize this data. It reveals inefficiencies that spreadsheets hide.

2. Listen to the "Ground Truth"

Data has blind spots; your reps don't. They know the traffic bottlenecks and the difficult accounts.

- The Action: Host workshops to gather feedback on underserved regions.

- The Result: You catch errors early and build trust. When reps feel heard, they take ownership of the new map.

3. Design for Balance

Eliminate the gaps. Your goal is equal opportunity, not equal geographic size.

- Best Practice: Use customer density and revenue potential to guide the lines. Match territories to rep strengths (industry expertise, relationships).

- Pro Tip: Test different scenarios digitally before locking in the final design to prevent burnout.

4. Explain the "Why"

Change breeds anxiety. Transparency is your antidote.

- Don't just tell them what is changing. Explain why it is happening and how it helps them hit quota.

- Provide training and documentation so they can adapt quickly.

5. Track and Tweak

It’s not over at launch. Monitor the results to ensure alignment with market conditions.

- What to track: Revenue growth, customer satisfaction, and travel efficiency.

- Reality check: If gaps emerge, use real-time analytics to adjust immediately.

The Tech Advantage

Refreshing sales territories ;manually is complex and slow. The right technology makes it simple.

How tools like eSpatial help

- See the Big Picture: Visualize overlaps and gaps instantly.

- Work Smarter: Replace guesswork with data to maximize market potential.

- Adapt Fast: Adjust boundaries in seconds when the market shifts or the team expands.

The Bottom Line: A refresh isn't a short-term fix. It is your chance to build a scalable strategy. With powerful mapping software, you optimize coverage, balance workloads, and set the team up for long-term growth.

Frequently Asked Questions

When Should I Refresh My Sales Territories?

Don't wait for the annual plan. You should refresh whenever you see a disconnect between your map and market reality. Major triggers include mergers, new product launches, or a significant drop in conversion rates.

How Does Territory Design Impact Employee Retention?

Bad maps burn out good reps. If territories are unbalanced, high performers get frustrated by a lack of opportunity, while others drown in too much work. Fair distribution is a critical tool for stopping turnover.

Can't I Just Use Spreadsheets for This?

Spreadsheets have blind spots. They can’t show you the "Ghost Zones" (coverage gaps) or the overlaps that are killing your efficiency. You need mapping software to visualize the physical reality of your data.

What is the Biggest Risk of Ignoring Territory Alignment?

Revenue leakage. Without optimization, you are likely paying reps to fight over the same leads (cannibalization) while leaving high-potential areas completely untouched.

How Do I Get Sales Reps to Accept New Territories?

Transparency and data. Don't just hand down a new map. Explain the why, show them the data proving that the new territory offers a realistic path to hitting their quota.